September 2021 Full Inventory Report Trends

The Current Global and U.S. Crude Oil Market Situation and Key Messages and Implications to the U.S. Propane Market

The spread of the COVID-19 Delta variant in mainland China is creating another wave of potential disruptions, with a possible major implication to global and U.S. oil production rates. Travel restrictions are being re-enforced, which would possibly alter the outlook for oil demand in the world’s most important growth market. This demonstrates how rapidly market expectations can shift owing to outbreaks of the COVID-19 Delta variant. But the flipside is that fear of the Delta variant will motivate some previously unvaccinated people to get shots where available, therefore moderating the impact in due course.

The global oil demand increase expected for this year — the 7.5 million barrels per day (MMb/d) increase from February to July 2021 — has run its course. Europe, North America, and mainland China accounted for most of this demand spike. But new COVID-19 cases are rising in parts of North America and Europe. Mainland China’s “zero–COVID-19” policy means even very small outbreaks can lead to major travel restrictions. However, these three regions are among the most vaccinated places in the world, which provides protection against the reimposition of April 2020–style lockdowns. Delta cases could become more widespread in Asia, and especially in mainland China, and could severely lower global oil consumption. But that has not happened, and there is a high probability this could be avoided given Delta variant breakouts have tended to be contained after two months.

Despite cuts to our third-quarter 2021 demand outlook in mainland China and southeast Asia—a collective reduction of about 400,000 b/d from last month’s estimate—world oil demand is expected to hover around 98 to 99 MMb/d for the rest of 2021, close to the pre–COVID-19 level of 101 to 102 MMb/d. Upward revisions to demand elsewhere have largely offset the downward adjustment to Asian demand. But the oil market is still moving from a demand spike to a demand plateau, notably resonating to a view of flattening propane supplies from crude oil production.

The halt to world oil demand growth places greater importance on supply restraint. A matter that has received little attention could contribute to OPEC+ supply restraint is the Russian tax office. Absent a fiscal policy reset, IHS Markit estimates Russia’s potential to increase crude oil output between now and the end of 2022 to be just one-third of the 1.5 MMb/d increase that is currently planned for Russia’s OPEC+ quota over that same time frame. If demand is weaker than anticipated, then Russia’s tax policy may not matter. But a burst of demand growth—even if not until 2022—could reignite upward oil price pressure, something that the Delta variant has blunted, for now. Also, the Iranian saga continues, but this time with a new Iranian president. These talks, if there was an “overnight breakthrough,” would not lead to a surge in Iranian exports placing global crude oil pricing downward.

On the U.S. supply side, crude oil production growth is expected to resume in 2022. U.S. upstream capital expenditures are projected to rise from $60 billion in 2021 to $87 billion in 2022. Based on IHS Markit’s crude oil price outlook the industry is expected to generate a free cash flow margin of 35 percent and raise US output by 0.8 MMb/d from December 2021 to December 2022. This provides support for U.S. propane production gains for 2022.

Summarizing this month’s key global crude oil market messages:

- After a massive 7.5 MMb/d global oil demand increase from February to July 2021, demand will slow with a possible headwind being the COVID-19 Delta variant.

- Global crude oil demand is expected to plateau—little change relative to the 99 MMb/d estimated for third quarter 2021—until second quarter 2022.

- S. crude oil production growth for 2021 is minimal, as expected, but US crude oil production growth will resume in 2022 increasing incrementally by approximately 0.8 MMb/d on an entry to exit basis.

- Price outlook essentially unchanged from last month with dated Brent and WTI to average $69/bbl and $66/bbl, respectively, between August and December 2021 and annual Dated Brent and WTI prices for 2022 to average $66/bbl and $63/bbl, respectively.

It is important to note the U.S. crude oil supply and demand situation fits within the global oil fundamental market framework and the global crude oil balances and pricing are key market indications and drivers for US propane market supplies. Summarizing current global crude oil and U.S. propane pricing over the last month and the price linkages between the two are as follows:

- Average WTI crude oil price for the month of August was $68/bbl and $4 lower as compared to the last month average. The maximum daily price for the month of August was $73 and minimum daily price was $65/bbl.

- Average Mont Belvieu non-TET propane price for the month of August was 111 cents per gallon (cpg) and up 2 cpg compared to last month. The maximum daily price for the month of August was 115 and a minimum of 107 cpg.

- The Mont Belvieu propane price as percentage of the crude oil price averaged 68 percent for the month of August and 4 percent higher as compared to last month. The maximum daily propane price as a percentage of the crude oil price was 72 percent and the minimum daily was 63 percent.

The current U.S. propane market price continued its upward trajectory over the month of August highlighted by a slightly lower view in days of forward supply over the short-term and the upcoming US winter heating season. U.S. propane prices are currently trading in a range of 117 to almost 120 cpg. With the expectations of a colder than normal winter, prices will remain at and above this level through January 2022. If a major cold winter weather anomaly were to occur, then prices could easily break through a 130 cpg level.

The US Propane Market Outlook and Expectations – Hurricane Ida Was Quite Disruptive to the Louisiana Gulf Coast and Fortunately a “Non-Event” for the U.S. Propane Market

Hurricane Ida caused the shut-in of Gulf of Mexico production and ripped through Louisiana, impacting the power grid, refinery facilities, and petrochemical plants in its path. At peak, Hurricane Ida interrupted approximately 150,000 to 200,000 b/d of total natural gas liquids (NGL) supply from natural gas processing plants and approximately 60,000 to 90,000 b/d of total propane and butane production from refineries. The oil, natural gas, NGL, and petrochemical assets and related demand in the path of the hurricane were impacted along with supplies. Hurricane events in the past have impacted both supply and demand and, in this case, the same is true. Fortunately, the impact to the overall U.S. propane inventory system was minimal. Summarizing, Hurricane Ida U.S. propane market impacts are estimated to be short lived and have nearly recovered with only the lagging impact being felt from refinery outage.

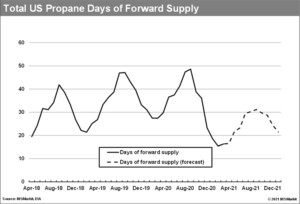

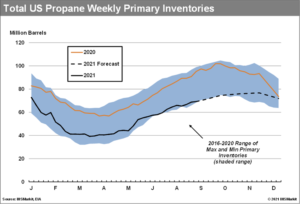

The U.S. propane inventory situation overall has worsened slightly as compared to last month’s trend report. Inventory levels are not expected to improve ahead of the upcoming U.S. winter season, and propane prices are moving higher. The inventory outlook could have been worse given the hurricane event on August 29, but the impact was minimal. The current estimated inventory level for August is approximately 70 million barrels (MMbbls) and 30 days of forward supply, almost 30 MMbbls and 17 days below the same time last year. IHS Markit expects inventory levels to decrease to a spring-time low point in March 2022 of almost 59 MMbbls, or 19 MMbbls and 5 days above the same time last year.

Ahead of the upcoming winter, slower supplies are not growing fast enough to build inventory in a meaningful way. Monthly propane production from natural gas processing for the forecast period, August 2021 through July 2022, was lowered by approximately 22,000 b/d offset slightly by small increases in refinery production, lower residential and commercial demand, small decreases in chemical demand, and small decreases in exports. Lower supplies with partial offsetting demand have led to a forward view of an even tighter market as the U.S. winter heating season approached. A few other factors included in the forecast, namely the upcoming crop drying season and the current outlook and base case for Heating Degree Days (HDDs) and rising exports. Propane demand for crop drying is expected to be less than average and might offer some relief to Midwest propane marketers. Weather so far has been hot and dry, supporting the market expectation of a less than average propane demand for crop drying and NOAA is forecasting higher HDDs and a colder winter compared to last year and slightly higher residential and commercial demand. Seasonal demand from Asia and petrochemical facility startups in mainland China to increase exports through the remainder of this year. January through July 2021 propane exports have averaged 1.31 MMB/d and are expected to average around 1.3 MMb/d for the balance of this year and increase further averaging 1.37 MMb/d for January through July 2022. Export demand remains strong driven by seasonal demand from Asian countries and startup of propane dehydrogenation (PDH) plants in mainland China. The U.S. supplies about 40 percent of mainland China’s import needs, and this could grow more if supply form Middle East remains low. The worsening inventory situation and the transition period to the U.S. winter heating season has alerted the market with the key measure being price.

U.S. propane market prices increased throughout the month of August. Strengthening Mont Belvieu propane prices along with global propane prices disconnected further from the global crude oil market and pricing. The propane market continues to tighten while the global crude oil market looks to be in a “better balance.” The daily Mont Belvieu propane price increased from around 107 cpg in early August to around 114 cpg by the end of the month and continues to rise while the WTI crude oil price traded in a relatively narrow band throughout the month. Correspondingly, IHS Markit has raised its Mont Belvieu propane price for the winter to average approximately 120 cpg for December through January, reflecting a 78 percent percent price ratio to WTI crude oil.

The situation will start to improve when compared to last year as propane supplies begin to grow again underpinned by U.S. Exploration & Production Companies (E&Ps) increasing drilling and completion activities into late 2021 and further into 2022. The inventory situation compared to last year will likely improve in December of this year and March 2022, barring any significant weather events, based on increasing propane production from natural gas processing and improving refinery throughputs.

The U.S. propane inventory in terms of days of forward supply for the balance of this year and through the forecast period, July 2022, has been lowered by 1 day to an average of approximately 27 days compared to last month’s report. The current forecast notes September 2021 as being a peak inventory level from a days of forward supply perspective, approximately 31 days, while the absolute inventory level peaks in November 2021 at almost 77 MMbbls. On an absolute basis the trajectory of total U.S. propane inventory is expected to be just below the 5-year average monthly minimum through September and October of this year before moving slightly above the 5-year average.

It is important to note the days of forward supply for July 2021 as reported by the EIA was approximately 30 days. The situation going forward will marginally improve to approximately 31 days in September and then drop to a seasonal low of approximately 20 days in February 2022. The February 2022 days of forward supply, albeit low, is an improvement compared to the same time last year. The inventory situation in March 2021 was approximately 16 days. So, this situation is expected to improve as the market passes through the upcoming US heating season, but risks remain over the next 5 months.

Note 1: IHS Markit has included below a US propane inventory chart and PADD inventory charts (in the Snapshot 08 (August) 2021 workbook and the “Weekly Inventory Charts 16-20” tab) over the inventory cycle comparing the current year, actual and forecast, versus last year. The weekly inventory charts have been updated to reflect the last 5 years data, full year 2016 through 2020. An additional chart has been added and reflects total US inventory expressed in days of forward supply.