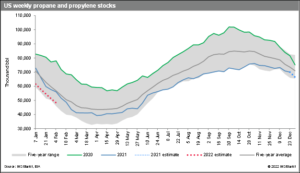

IHS Markit reports the propane market is “in relatively good shape” in relation to supply availability prior to entering the January/February peak demand season, barring a polar vortex occurrence or an extreme cold weather occurrence.

For the upcoming U.S. Energy Information Administration (EIA) weekly report, IHS Markit projects a propane and propylene inventory decrease of 2.366 MMbbl for the week ending December 31, resulting from a projected demand and supply of 2.945 MMb/d and 2.607 MMb/d, respectively. The projected stock drop is in line with the average stock decline for the first three weeks of December, and the projected average stock drop of 2.3 MMbbl is 38 percent lower than December 2020.

IHS Markit notes the exports projection remains steady at 1.3 MMb/d, which is in line with the November/December average even though the EIA weekly data for the end of November and first half of December were significantly lower than expected. Supply is expected to remain relatively stable, thanks to what IHS Markit says is an ongoing record-setting weekly production trend and higher seasonal imports. The latest weekly natural gas pipeline scrape data and the corresponding propane production estimates show a slight uplift in production at the end of December, and at the same time, recovery refinery production is inching closer to pre-COVID levels.

In IHS Markit’s four-week forecast, the total January supply forecast is about 100,000 barrels/day higher than January 2020, thanks mainly to higher natural gas and refinery output while imports have increased and are at a level like the same period last year. But demand for January 2021 is expected to be 100,000 barrels/day lower than January 2020, and overall exports are expected to be close to the November/December average. The days of supply are expected to fall gradually to 17 by the end of January, down five days from the end of December. IHS Markit also notes that lower supply availability in the form of inventory is mainly traced to the Gulf Coast, while the other area stock levels are approaching or appear to be normal, including the Midwest stock level which is close to the five-year average.

IHS Markit also reports the U.S. propane market is expected to “reset” given the mild heating season for most of December, following the price moves in the fourth quarter 2021. IHS Markit says there is no major propane marketer catalyst for a sharp price spike in the near term, but that could change if there is a major cold weather event in January or February. The healthy supply and demand balance is also reflected in the relatively stable 62 percent propane-to-crude ratio at the end of December, and the propane-to-crude ratio is likely to stay in a tight range for now.

Read the full December 2021 report here.

Related News

USDA Crop Progress Report

April 25, 2024

The U.S. Department of Agriculture (USDA) Crop Report as of April 22, 2024, shows promising developments in corn and soybean planting, crucial info...

Webinar: International Market Dynamics in Propane

April 25, 2024

Join NPGA’s insightful webinar on May 16th at 2 pm ET, focusing on the complexities of international propane markets and their impact on the ...

Expo Call for Presentations

April 25, 2024

Submit your idea today! The National Propane Gas Association is now accepting education and fast track session proposals for the 2025 Southeastern ...