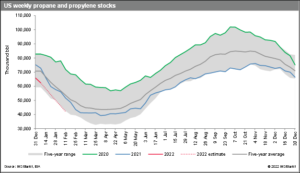

IHS Markit reports the inventory decline over the last week was the deepest one-week decline since mid-February 2021 and is expected to drop the days of supply below 20 days for the first time since the last week of April.

For the upcoming U.S. Energy Information Administration (EIA) weekly report, IHS Markit projects a propane and propylene inventory decrease of 4.096 MMbbl for the week ending January 14, resulting from a projected demand and supply of 3.16 MMb/d and 2.575 MMb/d, respectively. The higher week-on-week total demand is traced to the strong seasonal heating requirements, with exports projected to remain stable. Total supply is expected to rise higher from the previous week, but it remains slightly under the high of 2.6 MMb/d recorded in mid-December 2021. Production is continuing to recover from the unexpected end-December dip, and the overall average import remains stable, owing to the absence of financial incentives and a significant spike in physical demand in the US Midwest and Northeast.

IHS Markit’s four-week forecast notes steeper projected demand through February, with significantly higher heating degree days than November and December. The total demand on average is expected to be well above 3 MMbbl in January-February, with expectations of a colder-than-normal 10-year average temperature this winter as well as a robust export flow. IHS Markit predicts the absolute peak demand is expected to occur around the last week of January, about one week later than 2021.

With increased demand, IHS Markit reports while most Midwest regional markets have an adequate supply of above the five-year average, there is a potential market risk with the possibility of Upper Midwest supply constraints, noting the Upper Midwest is the market with the smallest inventory at only 500,000 bbl, which is about 300,000 bbl lower than a year ago. Wisconsin, Iowa, and Minnesota are the only states in the Midwest with a weekly inventory under the five-year range. The overall Midwest stock is 2 MMbbl higher than a year ago, but the supply distribution appears to be lopsided. The tighter supply availability in Wisconsin, Iowa, and Minnesota has already elevated wholesale rack and retail prices to incentivize longer distance supply deliveries via trucks and rail.

IHS Markit also reports the Gulf Coast propane continues to face sharp stock drawdown. The total stock decline from November through early January was 7 MMbbl over 10 weeks. Based on an assumption of another 7 MMbbl drop over next 10 weeks, and steady export and production, the Gulf Coast could fall to 22 MMbbl by early March. IHS Markit notes a free-falling Gulf Coast stock could have an impact on Mont Belvieu prices, propane-to-crude ratio, Mont Belvieu-Conway price spread as well as export economics, but the timing of the potential sharper stock drop coincides with the tail-end of the heating demand season.

Read the full January 2022 report here.

Related News

USDA Crop Progress Report

April 25, 2024

The U.S. Department of Agriculture (USDA) Crop Report as of April 22, 2024, shows promising developments in corn and soybean planting, crucial info...

Webinar: International Market Dynamics in Propane

April 25, 2024

Join NPGA’s insightful webinar on May 16th at 2 pm ET, focusing on the complexities of international propane markets and their impact on the ...

Expo Call for Presentations

April 25, 2024

Submit your idea today! The National Propane Gas Association is now accepting education and fast track session proposals for the 2025 Southeastern ...