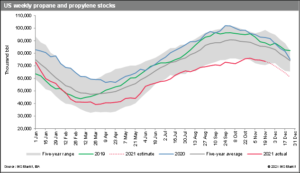

IHS Markit latest propane market forecast marks the start of the winter peak demand season, anticipating December inventory decline will accelerate and fall to 60 million barrels by year-end.

For the upcoming U.S. Energy Information Administration (EIA) weekly report, IHS Markit projects a propane and propylene inventory decrease of 1.518 MMbbl for the week ending November 26, resulting from a projected demand and supply of 2.760 MMb/d and 2.543 MMb/d, respectively. November was a transition month for domestic demand, with the rise in heating partially offset by the falling crop drying demand.

In IHS Markit’s four-week forecast, the end of December stock is expected to be 14 MMbbl lower than 2020 and 21 MMbbl lower than 2019, and the end of December stock would be 4.5 MMbbl below the five-year range. Days of forward supply is projected to fall by seven days in December to 21, which would be the lowest end of December estimate in the past six years, with the end of December days of forward supply ranging between 23-33.

IHS Markit notes the takeway from the recent propane price volatility is that the propane cash flat price will continue to fluctuate in tandem with the crude price swings, and propane price support for a stronger propane-to-crude ratio may not materialize until the peak seasonal demand kicks in or when the weekly stock begins to fall significantly. IHS Markit reports the propane market situation could be oversold after falling quickly and sharply from the recent high of 152 cents per gallon on October 4, signaling a potential upside or price correction. The propane ratio is not expected to make a significant upward push until the first sign of the weekly seasonal stock drop in a meaningful way, possibly in early December.

Read the full November 2021 report here.

Related News

USDA Crop Progress Report

April 25, 2024

The U.S. Department of Agriculture (USDA) Crop Report as of April 22, 2024, shows promising developments in corn and soybean planting, crucial info...

Webinar: International Market Dynamics in Propane

April 25, 2024

Join NPGA’s insightful webinar on May 16th at 2 pm ET, focusing on the complexities of international propane markets and their impact on the ...

Expo Call for Presentations

April 25, 2024

Submit your idea today! The National Propane Gas Association is now accepting education and fast track session proposals for the 2025 Southeastern ...