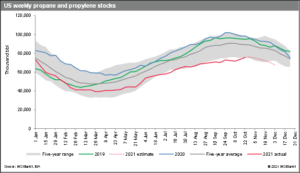

IHS Markit’s four-week forecast shows an accelerated stock drop, with a total estimated inventory decrease of 7.5 million barrels, with a possible “red flag” in the very short-term forecast with days of supply falling to 25 in early December.

For the upcoming U.S. Energy Information Administration (EIA) weekly report, IHS Markit projects a propane and propylene inventory decrease of 1.168 MMbbl for the week ending November 5, resulting from a projected demand and supply of 2.603 MMb/d and 2.437 MMb/d, respectively. The latest projected weekly stock drop, which is slightly later than the typical October seasonal stock decline in the past several years, represents what IHS Markit calls “the definitive seasonal decline for 2021,” with total demand rising over 2.6 MMb/d for the first time since the last week of March. The days of forward supply is projected to fall by two days from the previous week to 31.

Adding to the four-week forecast, IHS Markit notes that propane supply may go into peak winter demand season at close to 20 days of forward supply. The supply availability could be perceived as tight when the days of forward supply drops below 20 days, but IHS Markit reports that does not mean the market would run out of supply but demand is expected to outgain supply significantly. IHS Markit notes its definition of “critical” may change over time as each regional requirement becomes bifurcated, with PADD 3 more connected to exports and ratable with inventory changes in a tighter band over the season, while the other PADDs, especially PADDs 1 and 2, remain to be seasonally managed. The midwest and northeast may not get much resupply help from Canada, waterborne imports and export-focused Gulf Coast this year if a colder-than-expected weather event occurs.

IHS Markit reports the weekly market sentiment has fluctuated wildly from very bullish in September to bearish in late October and early November. IHS Markit notes the latest market sentiment is bearish for now, but the market outlook remains cautiously bullish looking forward and realizing the inevitable seasonal demand increase with lower temperatures. The latest propane price weakness, which could be temporary, is attributed to the unexpected consistent weekly stock increases in October, prompting long liquidation and profit taking.

Read the full November 2021 report here.

Related News

USDA Crop Progress Report

April 18, 2024

The U.S. Department of Agriculture (USDA) Crop Report as of April 14, 2024, shows promising developments in corn and soybean planting, crucial info...

RBN Energy Weekly Supply Update

April 18, 2024

U.S. propane inventories had a significant build of 4 MMbbl this week, putting propane inventories at 55.7 MMbbl. Total propane stocks are above th...

PERC Hosts Contest at FFA Convention

April 18, 2024

The Propane Education & Research Council (PERC) recently hosted an exciting contest at the 2023 Future Farmers of America (FFA) Convention. As ...