August 2021 Full Inventory Report Trends

The Current Global and U.S. Crude Oil Market Situation

The April 2020 OPEC+ supply deal has been a great success for its participants, resulting in dated Brent prices rising from an average of approximately $19/bbl in April 2020 to $76/bbl in July 2021. However, successes lead to challenges, and Saudi Arabia and the UAE disagreed on certain aspects of the forward supply commitments, quotas, and resulting market shares. The commercial impasse was alleviated, and on July 14, and an agreement in principle was reached between Saudi Arabia and the United Arab Emirates (UAE), with official confirmation to follow. Risks remain, with the primary concern being disgruntled OPEC+ members and the possibility of higher-than-expected production quotas that could lead to oil supply surpluses later this year and in 2022. This would be a welcomed relief to the global and U.S. propane markets from limiting supplies and higher pricing. This crude oil over-supply possibility is concerning to not only OPEC member countries but also to non-OPEC member countries, specifically the U.S. In the case of the U.S., this would negatively impact their profitability and operability and would further challenge the U.S. upstream oil and natural gas industry participants.

There is a lot at stake for all oil producers, yet an agreement failure even at the last minute can never be ruled out—and the willingness of Russia, Iraq, and others to accept the Saudi Arabia-UAE deal is an open question. A failure in the talks could prompt oil producers to ignore quota limits and unilaterally increase output, signaling a loss of Saudi Arabian and Russian supply management “system” in play, at least for a time.

It is important to understand the myriad of supply drivers including investment in crude capacity. When a country invests in increasing production capacity it wants to produce more oil with the objective of capturing higher profits from higher prices and protect or gain market share. The objective is not to lower prices. In line with this objective is expected crude oil production increases in the U.S. IHS Markit expects minimal incremental supplies from the U.S. for the balance of 2021, but for 2022 the expectation is the US to grow production by more than 0.7 million b/d, entry to exit basis.

From a global crude oil demand perspective, the expected 7 million b/d spike in world oil demand from first to third quarter 2021 was an essential catalyst of higher oil prices, but the velocity of demand growth is expected to ease later this year. IHS Markit expects world oil demand will only increase 0.3 million b/d from third to fourth quarter 2021. This slowdown will place greater importance on supply restraint if prices are to continue rising. The 2021 demand spike gave Saudi Arabia and OPEC+ greatly enhanced, but temporary, oil market power.

Summarizing this month’s key global crude oil market messages:

- More oil supply is coming to the market—including from the U.S. and UAE—as the mid-2021 oil demand super spike begins to diminish and the temporary peak in Saudi Arabian oil market power eases.

- If the UAE is accommodated, other countries, including Russia and Iraq, will be tempted to seek higher production quotas.

- The expected 7 million b/d spike in world oil demand from first to third quarter 2021 was an essential catalyst of higher oil prices, but the velocity of demand growth will ease considerably later this year.

- Prices above $60/bbl for WTI will permit U.S. companies to increase crude oil production by 0.7 million b/d from fourth quarter 2021 to fourth quarter 2022 and still have a free cash flow margin of 30 percent or higher.

- S. supply growth will not unilaterally overwhelm the market. Global demand in 2022 is projected to rise 3 million b/d from fourth quarter 2021 to fourth quarter 2022, but it underlines that higher prices are leading to renewed U.S. growth.

- We project prices for dated Brent and WTI to ease after peaking in third quarter 2021 with dated Brent in second half 2021 is to average $70.75/bbl and for WTI to average $67.90/bbl.

- For 2022, our dated Brent and WTI price projections are $66/bbl and $63/bbl, respectively.

It is important to note the U.S. crude oil supply and demand situation fits within the global oil fundamental market framework and the global crude oil balances and pricing are key market indications and drivers for U.S. propane market supplies. Summarizing current crude oil and propane pricing over the last month and price linkages between these prices are as follows:

- Average WTI crude oil price for the month of July was $72/bbl and $1 higher as compared to the last month average. The maximum daily price for the month of July was $75, and minimum daily price was $69/bbl.

- Average Mont Belvieu non-TET propane price for the month of July was 109 cents per gallon (cpg) and up 12 cpg compared to last month. The maximum daily price for the month of July was 113 and a minimum of 103 cpg.

- The Mont Belvieu propane price as percentage of the crude oil price averaged 64 percent for the month of July and 7 percent higher as compared to last month, the maximum daily propane price as a percentage of the crude oil price was 66 percent and the minimum daily was 61 percent.

The current U.S. propane market price remains quite high as compared to history given the supply and demand situation and the inability to build “normal” inventory levels ahead of the upcoming winter heating season. The supply and demand balances at the national level and PADD levels are in a somewhat dire situation for the upcoming heating season with little relief in sight. The inventory situation is expected to improve in 2022, but winter is coming, and expectations are clearly pointing to lower than normal inventory levels for the national level and PADD levels (excluding PADD 5) and higher prices.

The U.S. Propane Market Outlook and Expectations

The global propane market has grown accustomed and dependent on U.S. propane exports. Rising demand outside of the U.S. – mainly driven by Asia for propane for on-purpose propylene production and propane for ethylene production – and limited incremental production from other global sources of supply following the COVID-19 outbreak has created structural tightness. The global propane market is tight, and the U.S. market is following suit. U.S. PADD 3 and PADD 1 producing areas are expected to continue to lead the export charge as strong Asian propane prices keep the price arbitrage open when compared to Mont Belvieu price.

The U.S. propane market continues to be structurally tight, and the tightness is expected to remain through the upcoming U.S. winter heating season and for much of 2022. U.S. propane inventories are expected to build marginally through the summer season as the domestic demand peak has nearly passed and overall US propane inventory levels will increase at a slower rate as compared to history from now through the end of year. The current supply and demand and forward view will slightly improve the inventory situation, but the U.S. propane supply side is challenged. Two major U.S. supply side factors will limit significant upside propane production growth for the balance of 2021 and into the first half of 2022.

These two supply side propane production factors include U.S. upstream exploration and production companies (E&Ps) limiting their drilling and well completion activities and a forward price propane market unsupportive for producing and storing for the upcoming winter heating season. The U.S. upstream E&Ps continue to take a pragmatic approach to growing production as they focus on returning value to their shareholders despite the rising crude oil price. This has been the primary theme post pandemic and will remain for the balance of 2021 and will continue for much of 2022. IHS Markit expects limited to minimal U.S. propane production growth from natural gas processing for the balanced of 2021. At the same time backwardated U.S. forwards propane price curve is not providing any financial incentives for U.S. domestic propane market players to build stocks just yet. As noted earlier the level of the build heavily depending on U.S. exports, demand for propane outside of the U.S. These factors – along with normal U.S. residential and commercial demand, global propane demand, and U.S. export requirements, as well as U.S. propane inventory levels (both in absolute terms and in terms of days of forward supply) – all point to the need of incremental supplies needed beyond E&P activity and field level propane production.

There is the possibility and expectation of increasing imports to support U.S. propane demand requirements. IHS Markit expects the call on propane imports to increase over the forecast period. Considering the supply situation overall, it has become apparent the role of imports is expected to increase for the balance of 2021 and for much of 2022. Expected and forecasted higher level of imports are supported by import economics and PADD level propane demand requirements outside of PADD 3. The expected incremental imports will help to alleviate some of the market tightness but the most significant contributor to the market need is propane production from natural gas processing resulting from U.S. upstream E&Ps drilling and well completion activities.

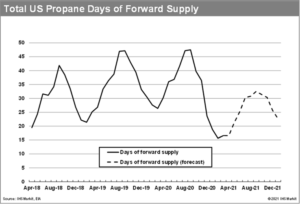

The national level monthly propane inventory levels for the forecasted balance of 2021 have improved as compared to last month’s trend report but remain well below inventory levels for the same time last year. Estimated inventory levels for June and July 2021 were 57.8 and 66.4 million barrels, respectively, and approximately 22 million barrels below last year’s level. The 22 million barrels is the equivalent of approximately 11 days of forward supply. The estimated days of forward supply for June and July 2021 are approximately 28 days and at the same time last year in inventory levels were approximately 40 days, with last year reflecting a relatively well supplied market and propane pricing around 50 cpg.

Inventory levels at the same time last year were comparable to the 5-year average, with 76 million barrels and 39 days forward supply. The 5-year minimum inventory levels for June and July is approximately 62 million barrels and 31 days of forward supply. The current U.S. propane inventory level is sitting on the 5-year minimum and is expected to improve and but is not expected to approach the 5-year average inventory level until possibly December 2021.

Risks to the forecast remain with imports and exports having the most significant impacts positively and negatively to the balances and propane pricing when considering an increase in inventory levels by year-end 2021.

The current trend report forecast changes for June 2021 through June 2022 are summarized as follows:

- Increasing supplies from natural gas processing from increasing upstream activity.

- Increasing supplies from refineries from slightly higher run rates.

- Increasing imports resulting from a view of improving import economics.

- Increasing residential and commercial demand resulting from an improved understanding and heating degree days and seasonal demand from this end use market.

- Decreasing chemical demand resulting from higher propane prices.

- Lower exports for 2021 and slightly higher exports for 2022 based on global supplies and incremental export economics.

In summary, these factors yield a slightly improved inventory situation for 2021 and 2022. The possibility of higher propane pricing along with higher price volatility will continue to be the theme for the balance of 2021 continuing through at least the first half of 2022.

Note 1: IHS Markit has included below a U.S. propane inventory chart and PADD inventory charts (in the Snapshot 08 (August) 2021 workbook and the “Weekly Inventory Charts 16-20” tab) over the inventory cycle comparing the current year, actual and forecast, versus last year. The weekly inventory charts have been updated to reflect the last 5 years data, full year 2016 through 2020. An additional chart has been added and reflects total US inventory expressed in days of forward supply.